|

George W. Bush 2000 On The Issues

Taxes

Governor Bush believes that roughly

one-quarter of the surplus should be returned to the people who earned it

through broad tax cuts – otherwise, Washington will spend it. His plan

will promote economic growth and increase access to the middle class by

cutting high marginal rates. It will also double the child credit,

eliminate the death tax, reduce the marriage penalty, and expand Education

Savings Accounts and charitable deductions. The largest percentage cuts

will go to the lowest income earners. As a result, 6 million families

will no longer pay federal income tax.

Governor Bush’s Principles

Trust People: Governor Bush believes all taxpayers should be

allowed to keep more of their own money. Every family faces different

challenges: some need better childcare, some need tutoring for their

children, and others need more after-school programs. Government cannot

tailor its programs to the needs of each family. The best way to help all

families is to let each family keep more of its income – and spend it as

it deems appropriate.

Lower the Record-High Tax Burden: Federal taxes are the highest

they have ever been during peacetime:

- Americans work more than four months a year on average to fund

government at all levels.

- The typical family now pays nearly 40 percent of their income in

taxes after accounting for all federal, state, and local taxes. This is

more than twice the rate paid by the typical family in 1955.

Cut Marginal Rates: As President Reagan demonstrated, the best

way to encourage economic growth is to cut marginal tax rates across all

tax brackets. According to Federal Reserve Chairman Alan Greenspan, “tax

reductions can offer favorable incentives for economic performance,”

“especially if designed to lower marginal rates.” That is why Governor

Bush’s tax reform proposal replaces the current five-rate structure with

four lower rates.

Increase Access to the Middle Class: Under current tax law,

low-income workers often pay the highest marginal rates. For example, a

single waitress supporting two children on an income of $22,000 faces a

higher marginal tax rate than a lawyer making $220,000. As a result,

the benefit to this waitress of taking an extra training course or

working an extra shift is cut in half by the government. Governor Bush

believes that we need to take down this tollbooth on the road to the

middle class. Under his plan, this waitress will pay no income tax at

all.

Cut Taxes Responsibly: Governor Bush’s $460 billion tax cut over

five years will contribute to raising the standard of living for all

Americans. His budget uses only about a quarter of the surplus for tax

cuts, reserves all Social Security funds for Social Security only, and

still leaves extra money for debt reduction, defense, education, and

other priorities.

Governor Bush’s Tax Cut Proposal

1. Increase access to the middle class for hard working families:

- Cut the current 15 percent tax bracket to 10 percent for the first

$6,000 of taxable income for singles, the first $10,000 for single

parents, and the first $12,000 for married couples.

- Double the child tax credit to $1,000.

2. Treat all middle class families more fairly:

- Cut the maximum tax rate for the middle class to 25 percent (versus

the current maximum rates of 28 and 31 percent).

- Greatly reduce the marriage penalty by restoring the 10 percent

deduction for two earner families, allowing them to deduct up to an

additional $3,000.

3. Encourage entrepreneurship and growth:

- Cap the top tax rate at 33 percent (down from the current 39.6

percent).

- Eliminate the death tax.

- Make the research and development tax credit permanent.

4. Promote charitable giving and education:

- Extend the deduction for charitable contributions to the 80 million

taxpayers that do not itemize, and raise the cap on corporate giving.

- Increase the annual contribution limit on Education Savings Accounts

from $500 to $5,000 per child.

Results of Governor Bush’s Tax Reform Proposal

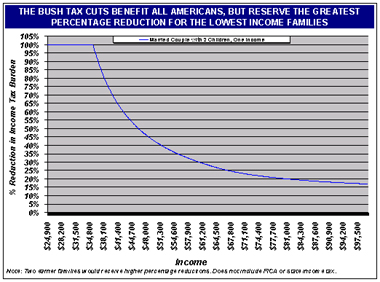

Under Governor Bush’s tax plan, the largest percentage reductions

will go to the lowest-income earners. As a result:

- Six million low- and moderate-income families will be removed from

the income tax rolls entirely. That is one out of every five families

with children.

- The marginal income tax rate on millions of low-income families will

fall by over 40 percent.

Tax Relief for Families of Four

- A family of four making $35,000 will receive a $1,500 tax cut, a 100

percent reduction.

- A family of four making $50,000 will receive a $2,000 tax cut, a 50

percent reduction.

- A family of four making $75,000 will receive a $2,500 tax cut, a 25

percent reduction.

Tax Relief for Single Parents

- A single mother with one child making $22,000 will receive a $1,000

tax cut, a 100 percent reduction.

- A single mother with two children making $32,000 will receive a

$1,500 tax cut, a 95 percent reduction.

Position Proposal & Speech

- Fact Sheet: A Tax Cut With A Purpose

- Speech: A Tax Cut With A Purpose

The Texas

Record

Governor Bush reached across party lines to deliver the two largest

tax cuts in Texas history: $1 billion in 1997 and $2 billion in

1999. Under Governor Bush:

- Texas has the 3rd lowest state tax burden in the country.

- State budget surpluses have increased from $333 million to a high of

$3.5 billion.

- Texas remains one of only a handful of states without an income tax.

Source: George W. Bush for President 2000 Web Site

©2000-2007 by the 4President Corporation |